Optimize authorization ratesEvery transaction counts

A market-leading transaction authorization rate, with optimization tools to take it even further.

Worldpay provides merchants with a best-in-class authorization rate, right from go live

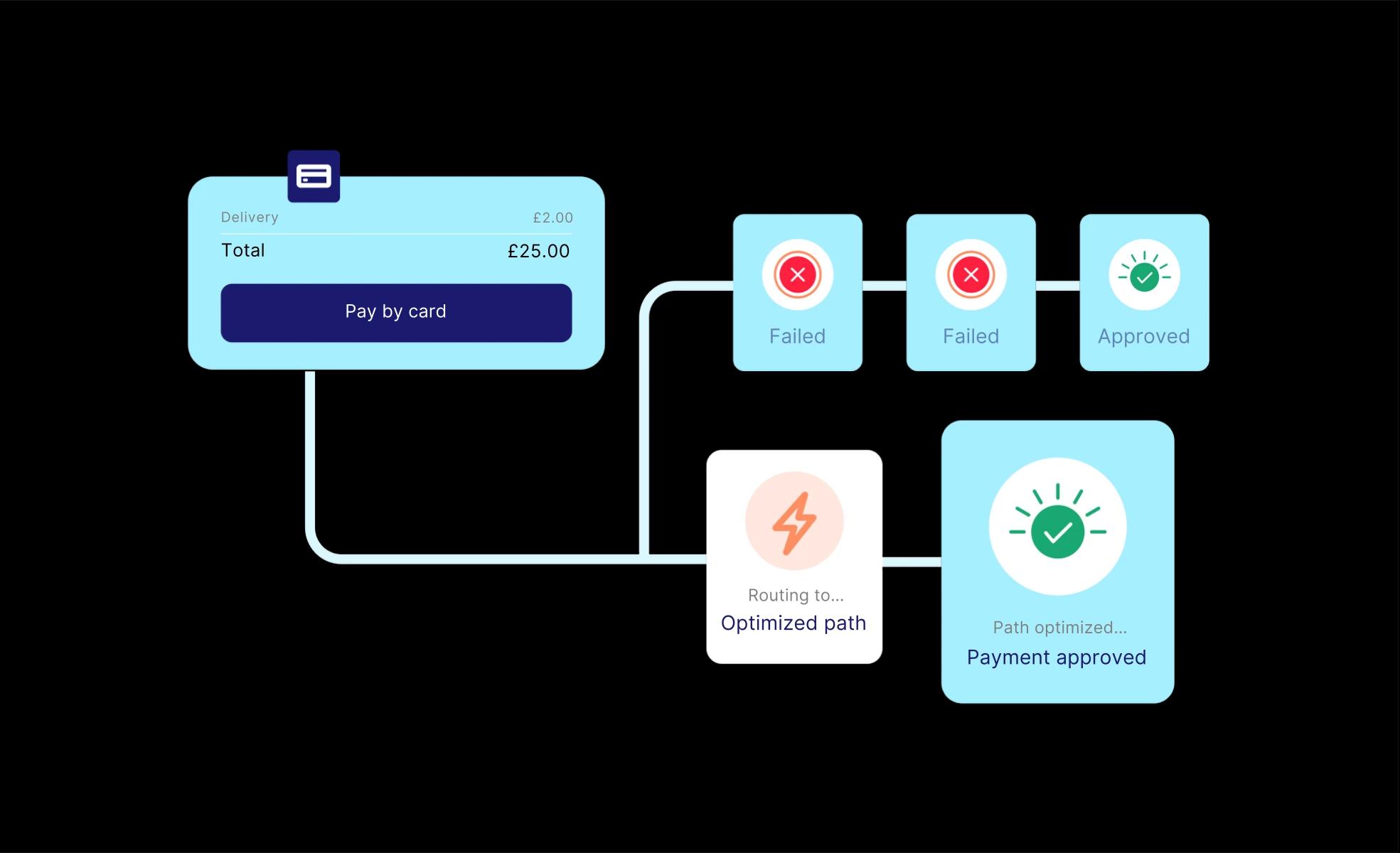

A high-performing auth rate isn’t just a metric—it’s the backbone of your revenue. Worldpay’s robust infrastructure and experience ensures more approved transactions from the start, reducing friction and maximizing conversion. Because when your baseline is strong, every transaction has a better chance to succeed.

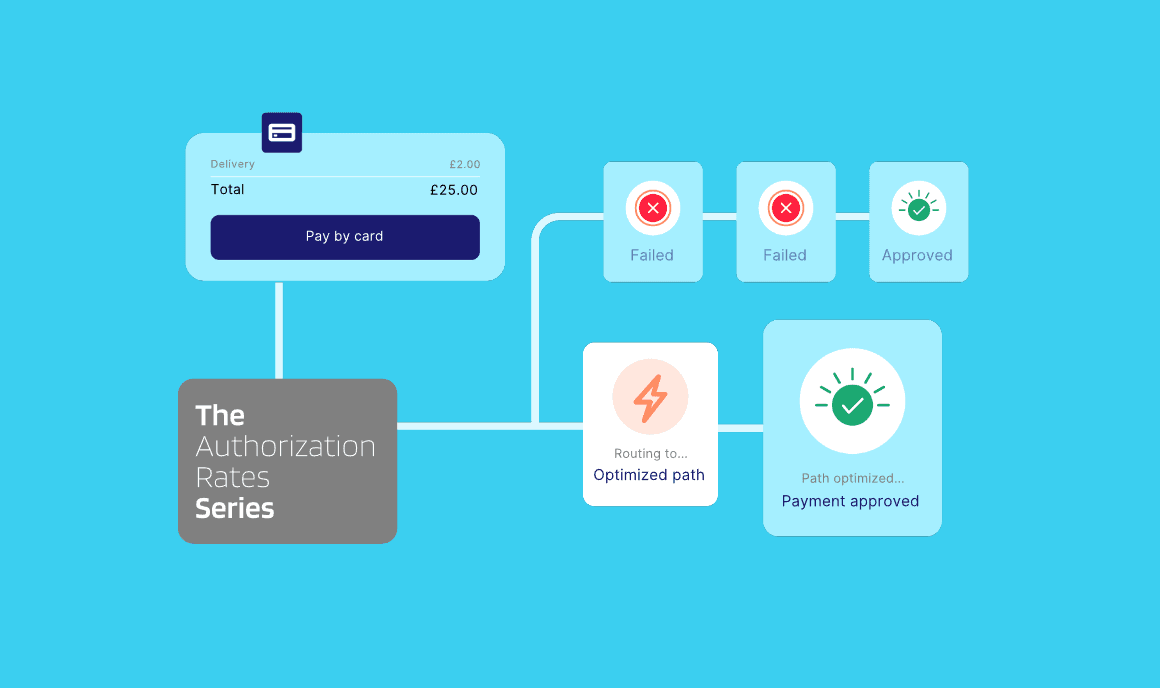

Insights series

A deep dive into authorization rates

This 5-part educational series explores how merchants can unlock hidden revenue by optimizing payment authorization rates – covering strategies from smart routing and credential management to global localization and executive-level performance insights.

Trusted across networks

“Worldpay’s authorization rate is best-in-class compared to peers in several verticals including drugstore and pharmacy, government, department stores and supermarkets.”

- A leading card network

What makes Worldpay's authorization rate so good?

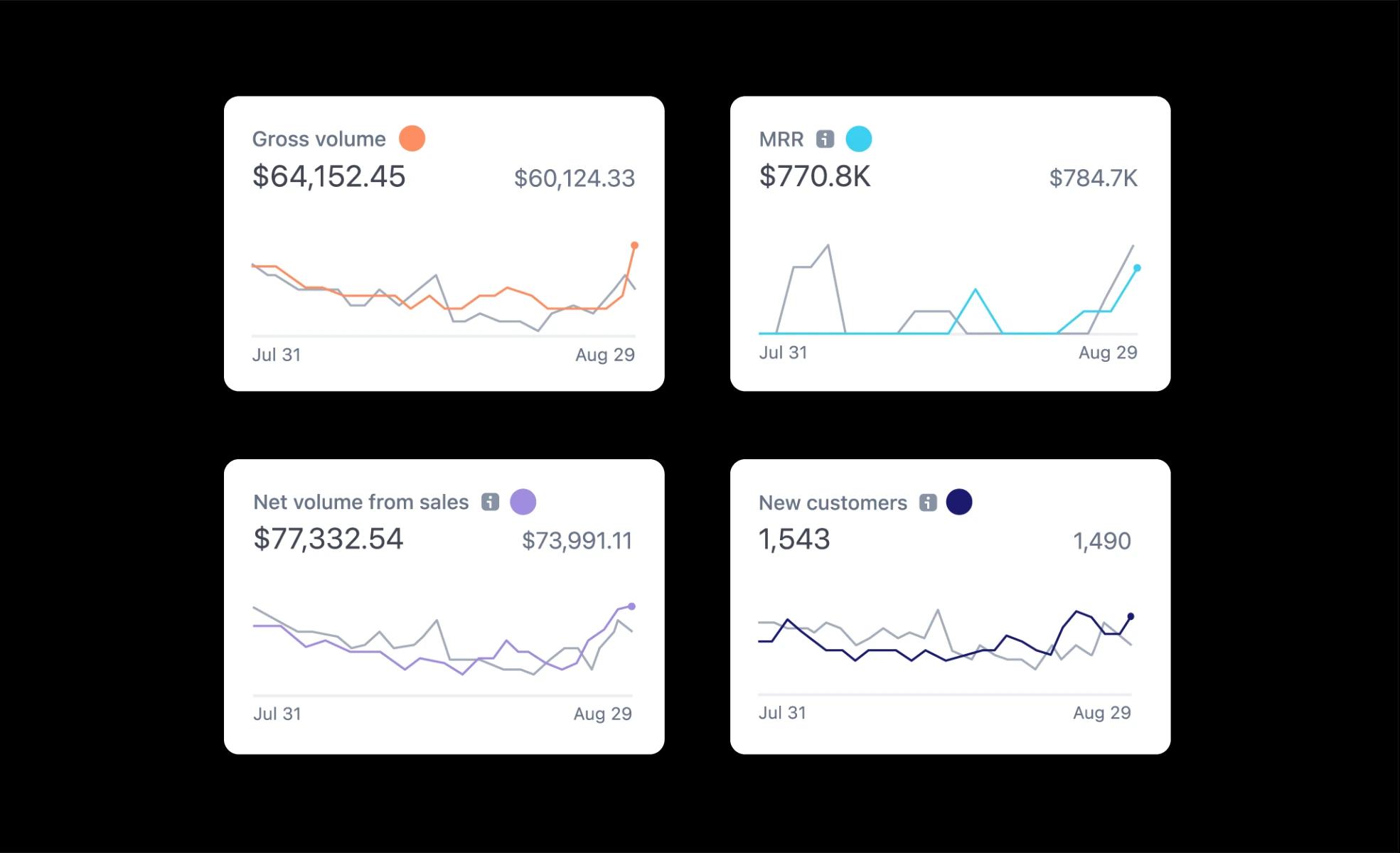

On average, customers can see 30% cost reduction in payment routing fees with dynamic routing.

Building on a strong foundation

With Worldpay, you can further optimize your authorization rates with customized tools and capabilities tailored to your business needs.

Boost

Boost revenue with a fully managed optimization service that uses all levers available to keep your auth rate in top shape. Making use of AI and data science signals (authentication factors) to drive higher approvals and long-term revenue.

Recovery

Extensive real-time account updater and retrying services keep customers’ details updated to minimize authorization declines. 9.3% typical lift in payment acceptance.

Credentials

Securely tokenize customer credentials and sensitive data to keep payment information active and always-on. Tokenization can deliver a typical 1.3% lift in payment acceptance.

Identify

Our reporting solutions help analyze your payments data, giving you information to minimize chargebacks and reconcile your transactions. Potentially stop 2/3 of chargebacks from occurring.

Let us optimize your payments

Talk to a Worldpay expert to get a personalized optimization consultation.