The bad guys don't care who pays the bill for gross fraud

Fraud costs either merchants or financial institutions plenty. Fraudsters don’t care who pays ─ but if you're liable, you likely have a big stake.

The bad guys don't care who pays the bill for gross fraud

Regardless of who commits fraud, one of two parties will pay for it: merchants or financial institutions. Fraudsters don’t care who picks up the tab, but if you’re one of the two parties being held liable, chances are you have significant interest.

Fighting fraud is a delicate balance between limiting the financial loss to merchants and financial institutions while increasing card users’ spending confidence. Studies have shown that when valid transactions are denied due to overly strict fraud controls, cardholders tend to switch cards and use cards they know will work.

No one benefits when a card is declined due to a false-positive. And fraud-related false positive declines are happening with more frequency, affecting 6.7 percent (1 in 15) of consumers.

To help illustrate the problem, each quarter, the major card brands take a look at gross fraud on a global scale. They look at three different categories:

- Worldwide fraud

- Fraud in the U.S.

- Fraud from all processors

Within these categories, there are two primary metrics that Worldpay is most concerned with: gross fraud and net fraud. The combination of merchant and financial institutions makes up gross fraud, where net fraud only accounts for what financial institutions are held liable.

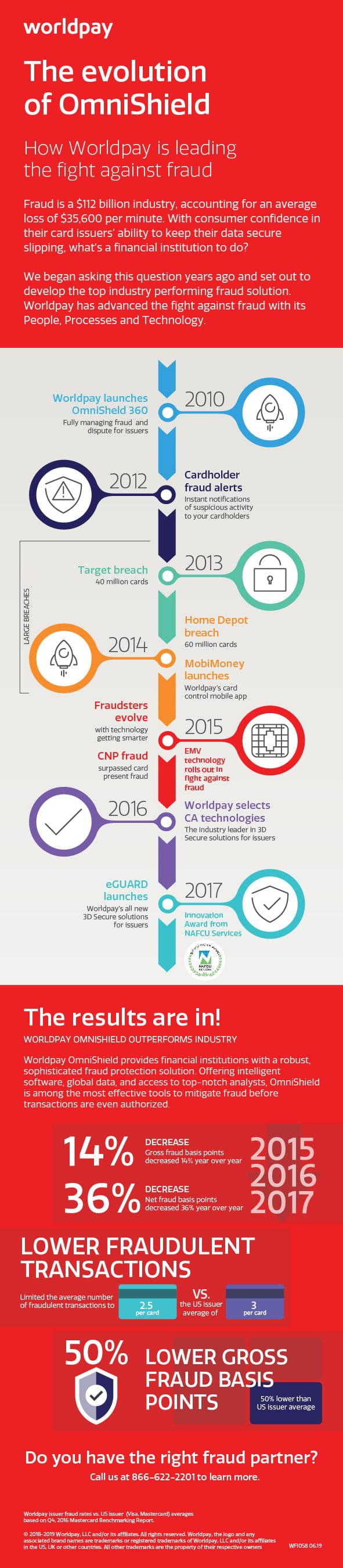

According to U.S. Issuer BPS based on Q2, 2018 Card Networks’ Benchmarking Reports, gross fraud for Worldpay issuers using OmniShield Fraud Suite for Financial institutions is 50 percent lower than the U.S. average. That’s great news for the financial institutions that work with Worldpay, but what's your experience like?

Now’s the time to reevaluate how well your fraud system is performing. When it comes to insulating yourself against fraud, why wouldn’t you want better? Discover the advantage of OmniShield Fraud Suite. Start with a look at the infographic available right here. Then find out how we can help your financial institution by calling us today.

Related Insights