Mapping the emerging models of agentic commerce

“Agentic commerce” means different things to different people; at Worldpay, we’re helping you cut through that complexity. (Part 4)

This Insights series explores agentic commerce – a transformative shift where AI agents take the lead in shopping, payments and customer decision-making.

As generative AI and autonomous agents evolve, we're starting to see the contours of a new kind of commerce – one that doesn't rely on user interaction at every step.

Agentic commerce promises to shift how shoppers discover, evaluate and ultimately pay for goods and services. But the space is still nascent: Innovation is happening non-uniformly across multiple domains, and that means it's easy for definitions to become muddled.

To help bring some clarity, we’ll break down the six distinct models of agentic commerce that we're starting to see emerge, with a particular lens on how payments intersect with each one.

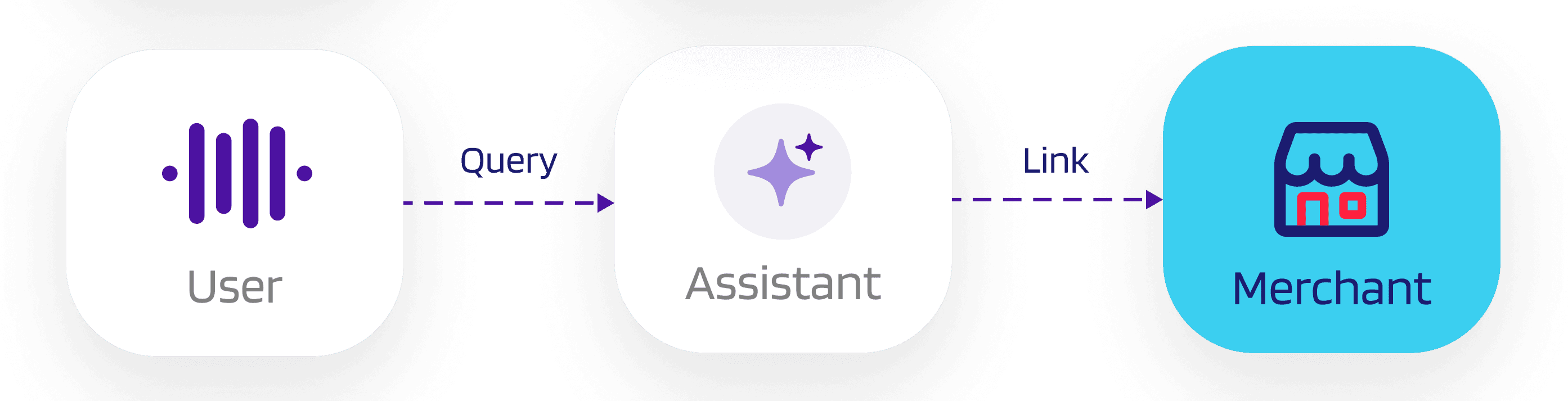

Model 1: Assistants in closed ecosystems

Conversational commerce: Shopping assistants deployed within a single merchant's (or platform's) environment

While the term "conversational commerce" has been around since 2015, recent advances in generative AI (GenAI) have significantly enhanced the utility of these assistants as shopping tools.

This concept – exemplified by tools like Amazon's Alexa and Walmart’s Sparky – continues to be an area of focus for merchants and platforms as they can help streamline the experience by guiding shoppers through discovery and purchase flows after the shopper provides their intent in natural language.

Because both the assistant and the backend payment implementation are controlled by the same entity, these journeys are easily achievable via well-understood components like payment links, embedded checkouts and stored credentials.

While there isn't really anything "agentic" going on in this model, these assistants do provide contextually relevant information and help facilitate transactions. What they don’t do is make decisions independently or execute payments autonomously.

A natural extension of this model involves leveraging headless architecture to embed specific closed ecosystems in third-party interfaces. We’re starting to see platforms like Shopify make inroads here with the recent launch of their Catalog MCP server, which enables agent developers to build native discovery and checkout experiences across Shopify’s entire merchant base.

The future of this model hinges on consumer preference. Which will they value more: Choice or convenience? In vendor-specific environments, traditional search-and-filter may beat conversational UX in many contexts. And in the headless scenario, the model introduces new layers of fragmentation, boxing consumers into a patchwork of overlapping marketplaces – and running counter to the open philosophy championed by many AI companies.

Model 2: Assistants with affiliate links

General-purpose assistants: AI tools and large language models (LLMs) acting as shopping advisors that recommend and link to products across the open web

Multimodal chatbots, like ChatGPT, have the capability to surface product recommendations from third-party sources and route users to merchant sites via affiliate links. In many ways, they act as glorified search engines, leveraging GenAI to parse options across the open web and make tailored suggestions.

AI assistants operating under this model are especially useful for spec-heavy, high-consideration purchases (e.g. electronics) where users want to compare across brands or models. However, currently, they often falter in domains where authentic or nuanced product data is scarce, or where bias towards well-indexed merchants skews results.

Since these assistants don't handle transactions themselves, payments are completed through existing merchant checkouts. Permalink technology (e.g. from Shopify) can pre-fill merchant carts to reduce friction, but redirecting users between interfaces like this frequently invites drop-off.

This is especially problematic given how conversion-sensitive affiliate models are. In fact, research from Adobe indicates that traffic from GenAI sources is 9% less likely to convert compared to other sources of traffic.

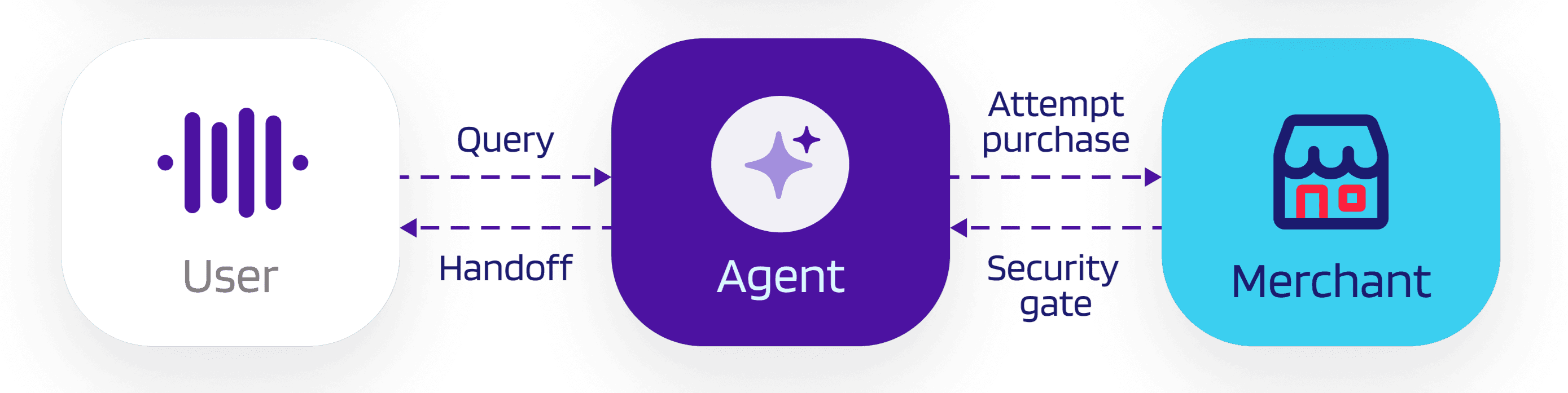

Model 3: Agents with Primary Account Numbers (PANs)

Semi-autonomous agents: The AI agent drives, but the customer needs to intervene

In this model, an AI agent, more specifically a browser agent like OpenAI Operator or ChatGPT Agent, can navigate the entire shopping experience on behalf of the user.

It can research products via headless browsers, run comparisons and even add items to carts without the user having to lift a finger.

However, this model has a significant limitation: Whenever the AI agent encounters a security measure (think login, CAPTCHA, payment), it needs to hand control back to the user before proceeding.

The result is a potentially frustrating shopping experience for the consumer as even after relinquishing control over product selections, they still need to be on hand to nudge their agent along to complete their purchase.

Even then, success isn't guaranteed: We're increasingly seeing commerce platforms (e.g. Shopify, Amazon) blocking this type of bot traffic due to fraud and security concerns.

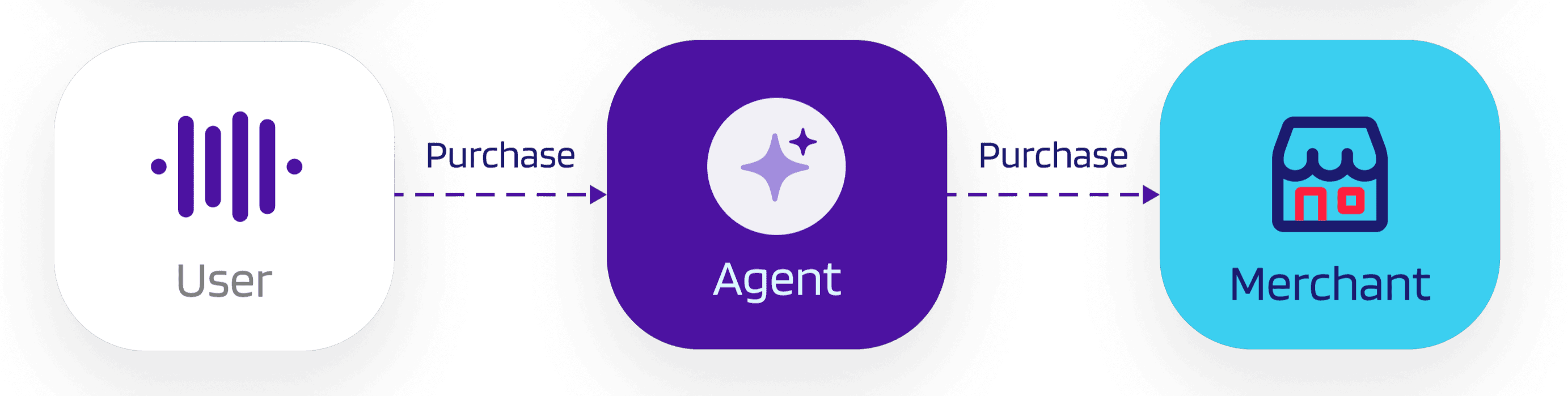

Model 4: Agents as the Merchants of Record (MOR)

Staged purchasing: You pay the agent; the agent pays the merchant

In this more vertically integrated model, the agent developer acts as the Merchant of Record (MOR). Perplexity Shop serves as an example of this flow, which can effectively be thought of as AI-enhanced dropshipping: The agent accepts payments from users, orders the items from the end merchant and ships them directly to the user, allowing the agent to operate without managing inventory or shipping logistics.

While the agent developer may hold direct relationships with some retailers to optimise commercial terms, they can break out of the closed silo by leveraging virtual card-issuing technology. Single-use cards can be generated and funded on the spot, assigned strict spending controls and used to check out at a merchant with whom the agent developer does not have a relationship (via a fulfilment agent).

This setup often creates more problems than it solves. For the consumer, transactions show up on their bank statements as having been paid to the AI platform, which can lead to confusion when trying to reconcile purchases.

In cases of fraud or dissatisfaction, consumers may struggle to determine who is accountable – the agent, the merchant or the fulfilment partner – complicating the resolution process. Traditional chargeback mechanisms may not apply cleanly, and customer service channels may be fragmented or poorly defined. This lack of transparency erodes trust and could deter repeat usage, particularly for high-value or sensitive purchases.

For merchants, a single customer might end up paying with a different "card" for each new purchase, hampering their reconciliation processes and loyalty/personalisation programs.

Lastly, for the agent developer, it's operationally intensive and they're taking on substantial operational and financial risk – particularly if they have to front the cost of purchases – so it doesn’t scale comfortably.

Indeed, companies deploying this model today are likely doing so primarily for experimental purposes – testing and learning on the front-end user experience to ensure readiness for the next model on our list.

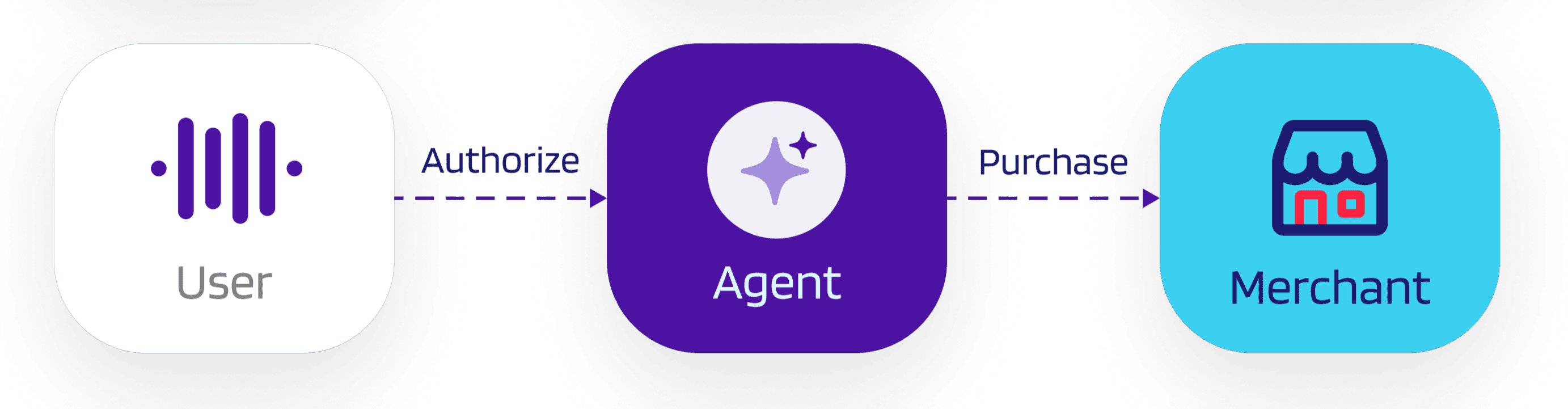

Model 5: Agents with tokens

Trusted AI agents: Tokenised credentials let agents pay securely on the user's behalf

There’s no real-world example of this model – yet. But it’s certainly on the horizon.

When it arrives, agents will have the ability to pay on behalf of shoppers (under delegated authority) using a tokenised, authenticated version of the shopper's credentials. These tokens may be generated by the networks (e.g. Visa, Mastercard, Google) and injected directly into the end merchant's checkout environment, or by third-party processors (e.g. Worldpay) and detokenised prior to injection via secure proxy.

In the near term, agents may crawl existing human-first checkout forms, but this is error-prone and subject to the same bot-blocker hurdles as Model 3. A more stable deployment would involve agents interacting directly with an agent-friendly interface (e.g. a merchant-operated MCP server).

In many ways, this flow is analogous to existing pass-through wallets (e.g. Apple Pay). The underlying merchant remains the MOR, and the agent simply facilitates secure and compliant credential handling. As such, the user experience pitfalls of the MOR model (Model 4) are largely avoided, and agents insulate themselves from the bulk of the risk.

"Simply" is doing a lot of work here – there are numerous challenges that need to be solved across fraud prevention, identity attestation, consumer intent, chargeback rules and liability, merchant registration, loyalty and brand exposure. But tokens offer the most feasible path to secure, scalable agentic commerce in open ecosystems.

Read more about how Worldpay is preparing for a future where agents will use tokens to transact across the internet.

Model 6: Agents with stablecoin wallets

Fully autonomous agents: Buying on your behalf with stablecoins

This is the most speculative and forward-looking model: an AI agent that understands user preferences, identifies needs, evaluates options and initiates payments – all without direct user input.

By leveraging stablecoin infrastructure this model can theoretically eliminate the need for explicit user authorisation for payments. Purchases on blockchain rails can embed programmable logic via smart contracts, retaining a robust audit trail throughout the lifecycle of the transaction. This could pave the way for the "checkout" to be abstracted away entirely, with agents free to operate within predefined user parameters.

Early real-world experiments include Telegram’s Bot Payments API and X-integrated Blormmy, but we have yet to see any mainstream applications of this model – and it may be some time before we do.

While distributed ledger technology (DLT) and smart contracts offer a compelling framework for programmable payments and auditability, they are not the only path forward. Traditional payment rails, combined with tokenised credentials and dynamic authorisation rules, can simulate smart contract-like behaviour. These approaches may lack decentralisation but benefit from broader adoption and regulatory clarity, making them viable alternatives depending on ecosystem needs.

The fundamental challenge is that hardly any consumers want to pay with stablecoins, and just as few merchants accept stablecoins as a payment or settlement option. While many ecosystem players are pushing for change here, for the time being, those gaps need to be bridged by complex on- and off-ramping procedures and workarounds, the costs of which may offset any value creation.

Cards and other payment methods are so thoroughly embedded into human psyches that it will take a Herculean effort to drive a worldwide shift to programmable money. And if we can get most of the way there with cards and tokens, that just might prove to be "good enough" for the ecosystem.

Closing thoughts

Agentic commerce is moving from concept to reality.

But the path to "end state" won't follow a predictable, linear pattern. Different models will suit different sectors, levels of user trust and degrees of merchant readiness. Some will be stepping stones; others may become the gold standard.

Our role at Worldpay is to support this evolution wherever it leads, enabling secure, flexible and intelligent payments – regardless of how the consumer (or the agent) wants to pay.

Previously in this series:

Part 3: Agentic commerce fraud: How to protect your online shop

In the age of agentic e-commerce, how can we identify and stop bad AI agents while ensuring we’re attractive to good AI agents?

Coming up next:

Part 5: Who do consumers trust with their data?

AI agents are shopping for us. But trust is deciding who gets to power the purchase.

Related Insights